for robust resilience and rapid business recovery.

for robust resilience and rapid business recovery.

Sheltered Harbor was founded as a not-for-profit standards setting and certification body to protect customers, financial institutions and public confidence in the financial system when a catastrophic event such as a cyber attack causes critical systems, including backups, to fail.

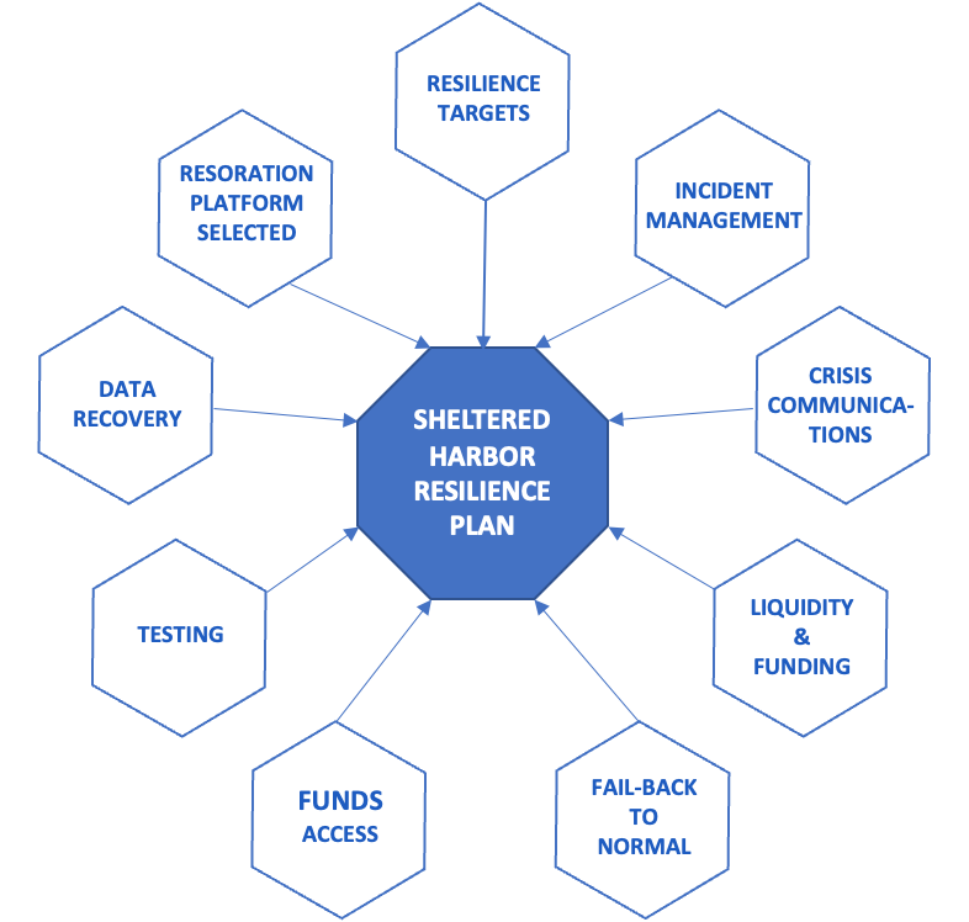

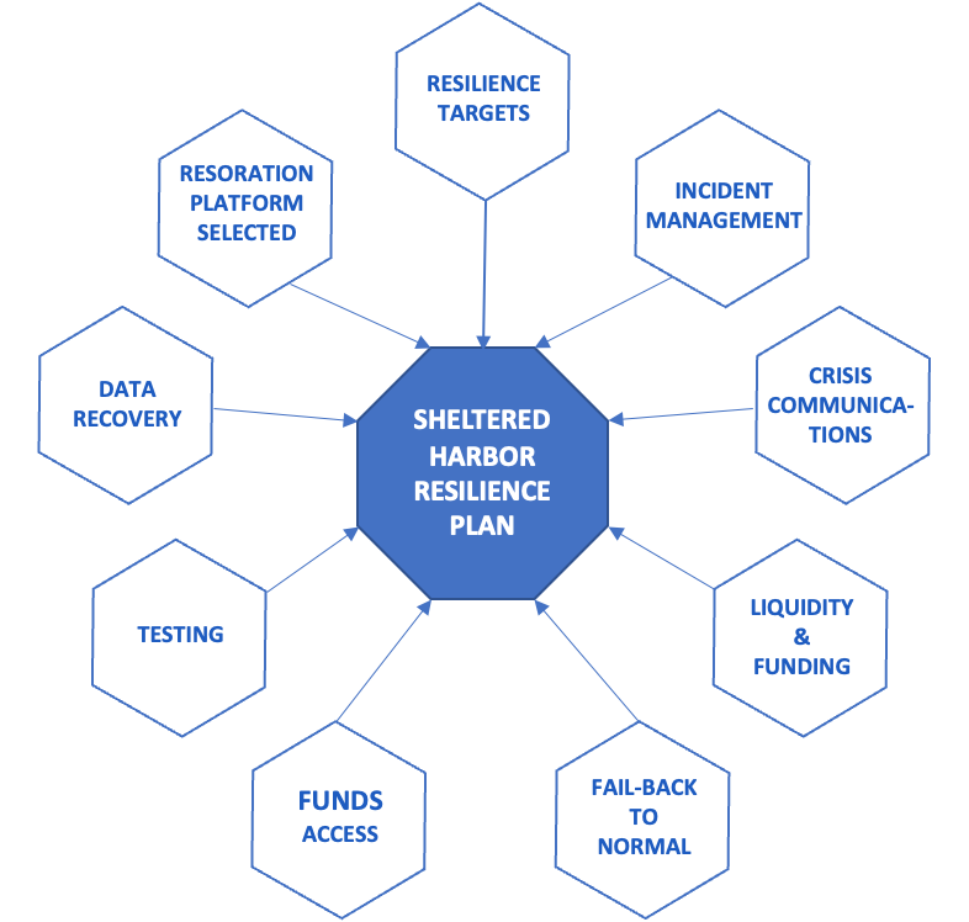

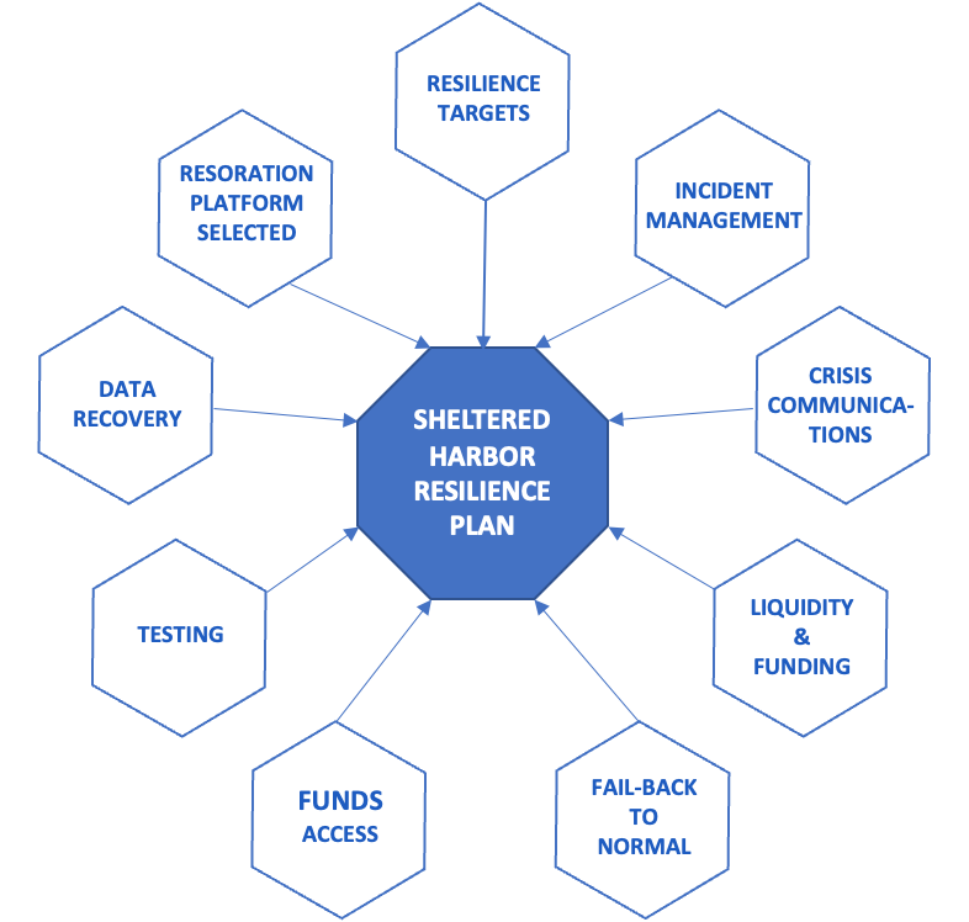

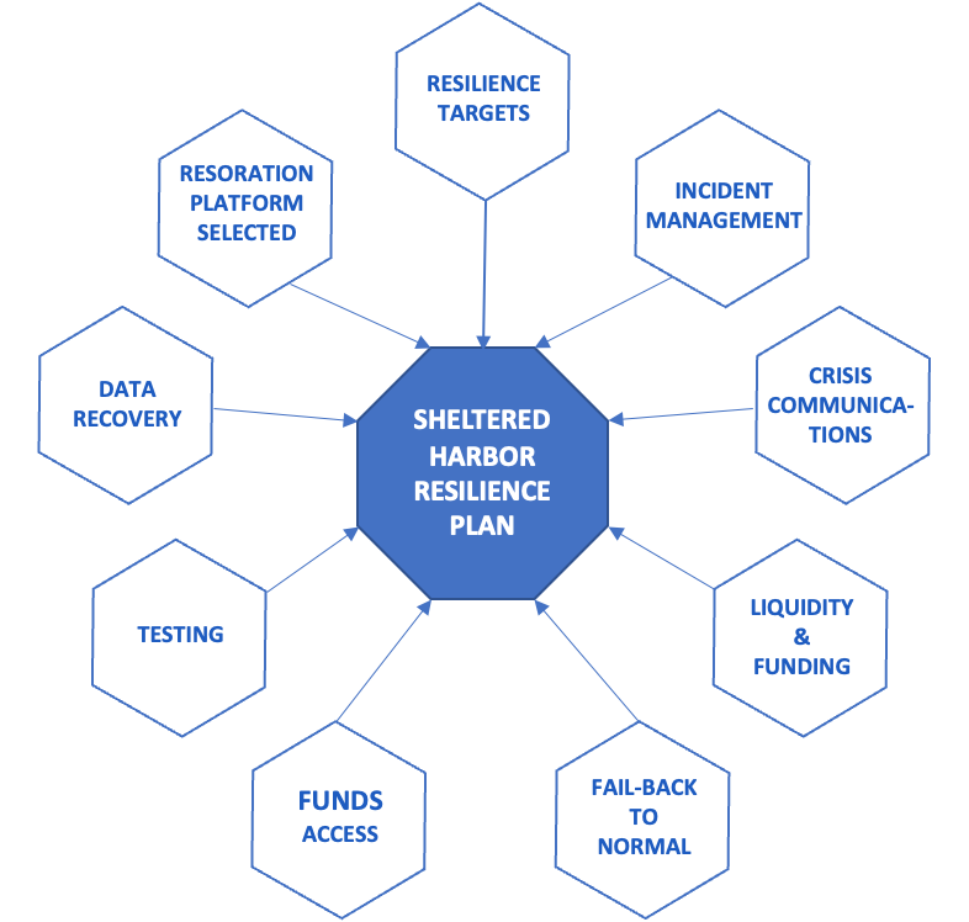

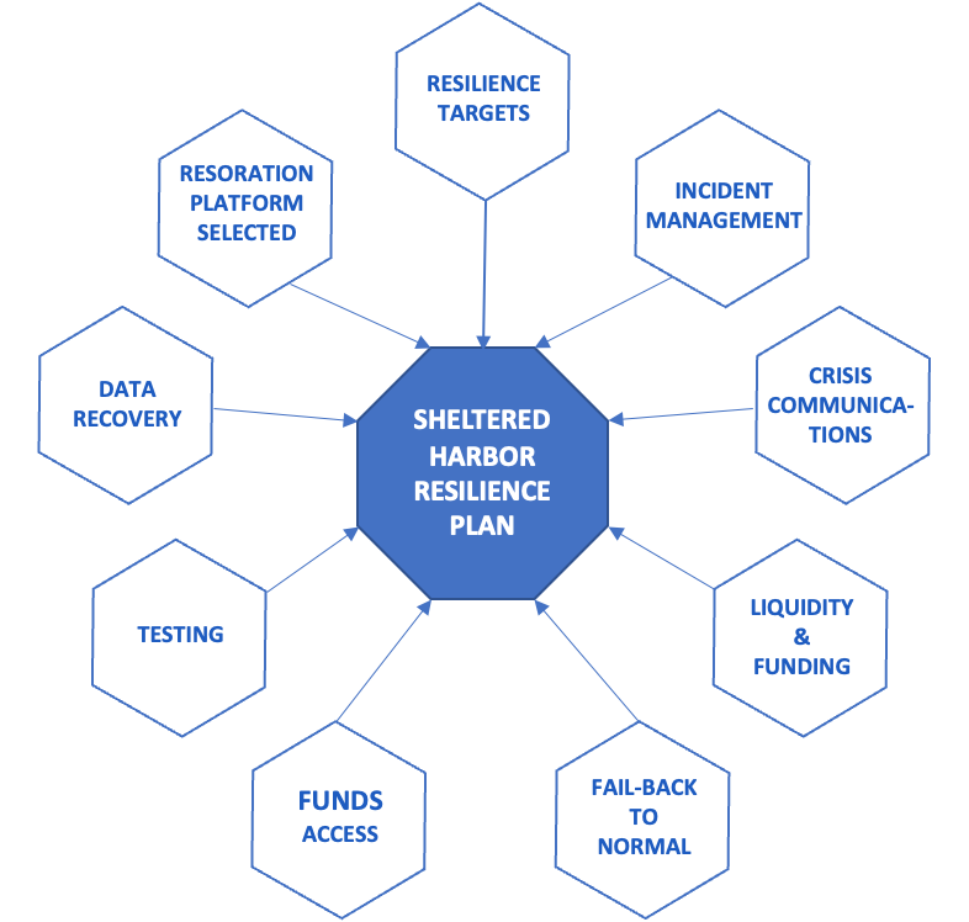

Sheltered Harbor's standards supplement Disaster Recovery (DR) and Business Continuity (BC) plans to help every participating organization prepare for and recover quickly from a severe operational outage, data corruption, or data deletion event. We promote adoption across the industry, support participants with implementation and ensure adherence through independent audits and certifications.

Moving quickly after a seismic cyber event is paramount to preserving the public’s confidence in the banking system, and Sheltered Harbor is the lifeline for resiliency. To maintain public confidence, community banks should make Sheltered Harbor certification a priority.

The Sheltered Harbor standards and certification process provides banks with an important tool to protect account holders and enhance a bank’s resiliency. This is particularly important now given the growing threats from destructive malware and ransomware attacks and the imperative that banks maintain and quickly recover immutable back-up data.

With the ever-growing threat and sophistication of ransomware, participation in Sheltered Harbor protects both the financial industry and consumers by ensuring that their most critical financial records are always safe and can be recovered. By adding Sheltered Harbor to your resiliency framework, you can do your part in guaranteeing that your account holders are always protected.

Smart Slider 3 is the best slider that i’ve tried so far. There’s so many useful functions and easy to understand how to use it.

Sheltered Harbor is a fundamental part of a resilience strategy, ensuring your business can recover and restore critical operations when all else fails. Every financial institution should be Sheltered Harbor Certified as it signals to consumers and regulators that your business prioritizes data security and resiliency in preparation for the unthinkable.

Sheltered Harbor is the only not-for-profit, industry-led organization founded to enhance the resilience and stability of the financial sector. Sheltered Harbor's standards help institutions plan for and recover from a catastrophic operational outage or loss of data, even when the institution’s critical systems, including backups, fail. This helps maintain customer confidence and buys the company time to restore normal operations.

Expert

Purpose-built by the financial services industry, for the industry, through a collaboration of hundreds of the top subject matter experts.

Adoption

Participating institutions hold a significant portion of the U.S. client deposit accounts and assets, with over 35% of institutions currently certified and growing.

Unique

Recognized by regulators as the gold standard for data protection, portability and recovery of access to essential services when critical systems fail. A backup of last resort.

Ecosystem

Broad industry backing includes major industry participants, associations, core service providers, alliance partner firms and regulatory support.

Control

At all times, participants maintain control of their own customer data, plans and processes.

Efficiency

This industry-defined gold standard leverages existing industry recognized standards and data formats and the cost to join is minimal.